Digital Accounting – Spend less time on paperwork and more time on your business

Our digital accounting services are ideal for small businesses. Being paperless, it is an easier and more efficient way to …

Experienced accountants, providing expert advice and services relating to tax, accounts vat and other business matters. Unlimited support, plus no contract and fair fees tailored to each client’s needs for most services.

Thompson Balch have been offering chartered accountancy services in Old Stratford, Buckinghamshire for over 25 years. We specialise in providing business advice, tax planning and advice, complex accounting services, payroll, VAT and Bookkeeping and can help move your business to digital accounting.

Mainly we provide accountancy services to small and medium sized business in and around Milton Keynes, Bedford, Northampton, Brackley, Towcester and Buckingham.

If you’re starting a new business or need support with a more established one, having the right accountants behind you is an important decision.

Our personalised accountancy and business support services are ideal for sole traders, start ups and limited companies alike. We have worked with some businesses for years and have developed long and enjoyable working relationships with many of our clients in and around the Milton Keynes and area. Our clients trust us to offer the best advice for their businesses, and we do not let them down.

"Taking the stress out of your business accounting"

Old Stratford and Milton Keynes

We offer a range of business services, our key areas of focus are helping new business get off the ground and supporting more established business throughout the year.

Our digital accounting services are ideal for small businesses. Being paperless, it is an easier and more efficient way to …

Trading through a limited company can be tax efficient for the extraction of profits. As a shareholder in your business you can pay yourself in the form of dividends (from retained profits after tax) which do not attract either employee or employer’s national insurance (at the moment!!).

We normally allow 24 hours but in most cases it can be quicker.

We can take over the administration for you and look at tax-efficient ways of extracting income for you and your family.

As a general rule it is ok to pay your spouse a small salary but:-the amount must be reasonable- must equate to what you would pay to a third party for the same duties and actually be paid to your spouse. However, it is also possible for your spouse to be a shareholder in your business and receive dividends. We would provide advice on a case by case basis once we know the facts.

As a general rule it is ok to pay your spouse a small salary but:-the amount must be reasonable- must equate to what you would pay to a third party for the same duties and actually be paid to your spouse. However, it is also possible for your spouse to be a shareholder in your business and receive dividends. We would provide advice on a case by case basis once we know the facts.

That contract would be treated as within IR35 and the required tax and NI would be charged. This would be after all allowable expenses, personal contributions and an allowance of 5% of invoices to cover notional expenses.

No. A Director can pay what level of salary they decide unless you happen to have a formal service contract with the company that dictate otherwise. We will discuss with you the level the salary should be set at for tax efficiency and personal requirements.

Yes – there is a HMRC guideline for such a calculation which we follow so that a deduction against profits can be made.

This would normally be our office.

We will commence registering you and your company (if applicable) with all of the relevant government bodies. We will also write to your previous Accountant/Adviser for professional clearance so that we have all the connecting information.

We can do this as soon as we have your contract and bank account details. HMRC can take about 4 weeks to send your registration notification.

Corporation tax is payable on business profits. and is not affected by the level of dividends. Higher rate personal tax is payable on dividends over the basic rate threshold.

There is a “nil” rate band of £2,000. All dividends above this level within the basic rate band are taxed at 7.5%. Once this total income exceeds the basic rate band the higher rate level of tax on dividends is 32.5%.

These are costs incurred that you would have been able to claim whilst you were trading eg. accountancy fees, rent, rates or stationery, etc. (s. 61 CTA 2009) However, the cost of a company formation is deemed to be a capital expense rather than a revenue expense and a tax deduction cannot be claimed regardless of when it is incurred.

As with all costs if the broadband connection is in the name of the limited company and is “wholly and exclusively” for business then a deduction can be made. If any personal use is purely incidental, and does not incur additional costs, then there will not be any tax or national insurance consequences.

If personal use is significant, and you do not reimburse your company for the personal use, then you will be taxed on the personal use as a benefit in kind. This will be advised to HMRC on form P11d and your company will have to account for Class 1a national insurance.

Where you do not have a broadband connection and you can show that this is required to do your work, then HMRC accept that this may be claimed.

The cost of entertaining clients is not tax-deductible. With regard to staff entertaining, you are allowed to claim the cost of one or more annual functions, as long as the cost to the company does not exceed £150 pa for each person who attends.

Send us your queries and we’ll be in touch!

© 2024 | Thompson Balch

Website by KC Graphics Ltd | Premium Hosting by Rocket

CO.REG.NO. 5474902. REGISTERED OFFICE: SOVEREIGN HOUSE, 15 TOWCESTER RD, OLD STRATFORD, MILTON KEYNES MK19 6ANUK

DIRECTORS: MRS DM BALCH ACA AND MR SA BALCH FCA

The EU GDPR is designed to help all of us have more control over our personal data, and how is it used.

Data subjects, being all visitors and users of any website who are members of the European Union, and therefore who submit personal data. Thompson Balch is the data processor and data controller of this site. You can find out more about this law here.

Effective from 25th May, 2018

This Privacy Policy sets out how we use and protect information that you may provide when you use this website. Your privacy is protected and important to us. If you provide identifiable personal information it will only be used to help us fulfil your project requirements.

Thompson Balch is the company who collects any personal data submitted through this website.

We may update this policy periodically, please check this page to ensure that you are in agreement with any changes.

Personal information, basically any data that can be used to identify or contact you is collected so we can service your requirements. This could include your name, business name, address details, email, telephone numbers, or information pertaining to your exhibition stand requirements. You may also at times be asked to leave a message about your enquiry or project brief. Websites also collect your IP address through the use of Cookies (find out more about cookies below).

If you opted-in to our mailing list, you may receive occasional emails on important updates or service information. You have the right to opt-out or and have any personal details removed at any time, please email us.

Information is saved until the enquiry is dealt with and then archived with the project or on cloud-based systems if you are an ongoing client. We also retain your contact details and information in the emails you have sent, but you can request to have your personal details deleted at any time.

We will not sell, distribute, or lease your personal information to third parties unless we have your express permission, or are required by law to do so. We may use your personal information to send you relevant information about the services we offer, or information you need as part of the services we offer.

In our continued commitment to ensuring that your information is secure and to prevent unauthorised access or disclosure, we have suitable physical, electronic and managerial procedures in place to safeguard and secure the information we collect online.

You may choose to restrict the collection or use of your personal information in the following ways:

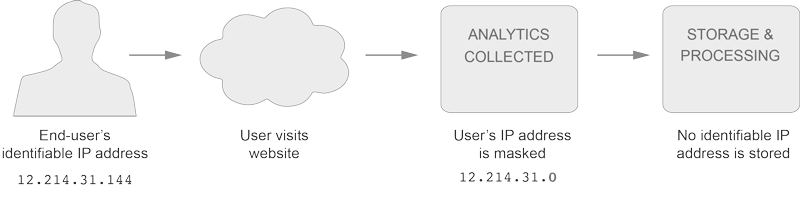

User-level and event-level data associated with Google Analytics cookies is retained for 14 months and then automatically deleted.

I have implemented IP Anonymization, simply put, the last three digits of your IP address are set to zeros in memory shortly after being sent to the Analytics Collection Network. The full IP address is never retained, or written to disk.

This site also uses Cookies, find out more or manage them here.